“Innovation Investment Strategy And Product Portfolio Optimization” with Jeff Lash, Research Director/Product Management, Sirius Decisions

By Helene Eichler

February 2014 Event

Jeff kicked-off an insightful discussion highlighting that many companies struggle with funding new product innovation and often lack a “structured strategy” for selecting investments that fuel successful business. Two astounding findings he shared:

- 34% of companies reported that 25% or more of their total product investment is spent on offerings that never make it to market

- 56% of companies reported that over half of their new offerings fail to meet the desired performance and financial targets

Since innovation investment decisions, portfolio optimization, and new product introduction/go-to-market processes are linked, Jeff recommended key stakeholders first ask four key questions:

- What areas should we invest in, how much should we invest and how does this align with our strategy?

- Within each area, which specific investments should we choose?

- How can we best innovate and bring them to market?

- Once an offering is in the market, should we enhance, maintain or sunset it?

What areas should we invest in, how much should we invest and how does this align with our strategy?

- Within each area, which specific investments should we choose?

- How can we best innovate and bring them to market?

- Once an offering is in the market, should we enhance, maintain or sunset it?

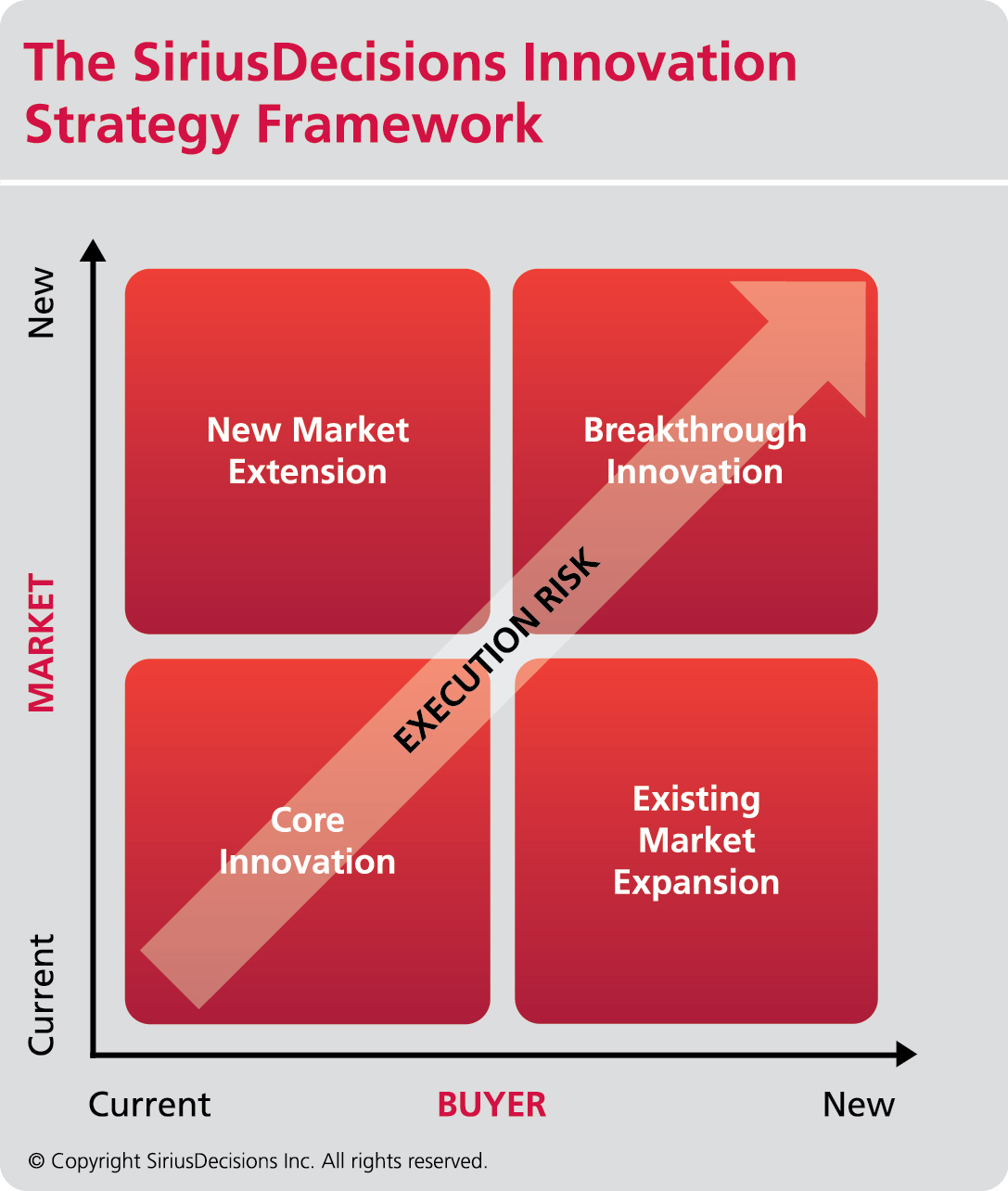

To tackle Question 1. What areas should we invest in, how much should we invest and how does this align with our strategy? He introduced us to the Sirius Decisions Innovations Strategy Framework.

The framework looks at four criteria:

- New Market Extension

- Breakthrough Innovation

- Core Innovation

- Existing Market Expansion

from a current and new Markets (Industry, Geography, Company Size), and current and new Buyers (Buyers’ Persona, Line of business, Budget Line) view. Once you define markets and buyers, you are ready to map potential product investment opportunities based on quadrant and size; but at this point don’t evaluate or rule any out. Jeff emphasized that identifying where your products map to this framework helps clarify what is feasible and reveals potential gaps.

The next logical step is to identify gaps in the buyer needs vs. your current product portfolio. Based on market opportunity and targets data, you’ll identify where and how much investment would be needed. This gap analysis looks at three factors:

- Identifying Market Opportunities

- Defining the Buyer Need

- Identifying the desired solution

Done right, market opportunity identification should guide investment allocation across innovation types based on growth potential.

So that leads us to question 2. Within each area, which specific investments should we choose?

Selecting the winning prospects requires:

- Choosing the right criteria (Selecting investments that align with your corporate strategy)

- Evaluating your ability to win in those markets (market entry timeframe, your potential marketshare, total market size)

- Looking at the fully loaded cost (Not only development, but sustaining and supporting)

Invest dedicate resources to innovative offerings wisely. So a mantra Jeff shared with attendees was “Part of Innovation is deciding what not to do!”

Now that you’ve selected prospective new product initiatives, the challenge is answering question 3. How can we best innovate and bring them to market?

To optimize these investments…

- Establish Clear KPIs and Metrics Prior to Launch

- Choose Predictive Metrics as Early Performance Indicators

- Review Metrics Regularly (at Least Monthly)

- Shift Resources, Budgets and Priorities to Stay on Track

- Make Small Bets and Test in the Market

- Adjust and retest in the Market as needed

A common mistake many companies make is not coordinating their investments in developing and enhancing products with their marketing and sales budgets. But best-in-class companies proactively evaluate and approve the full investment required to build, launch and support the product. Once the product exists over time in the market (that’s why we call it a product lifecycle), question 4. Should we enhance, maintain or sunset it? needs to be addressed. By looking at the product through strategic, financial, market and commercial lenses you see if the product continues to: Align with corporate strategy, meet financial KPIs, satisfy buyers’ needs and achieve profitability goals.

To make this work Jeff recommends implementing the following 7 action items:

- Determine strategy for desired markets and buying centers and align with corporate strategy

- Map market opportunities to the Innovation Strategy Framework

- Identify portfolio gaps that prevent current offerings from meeting market goals and use this analysis to guide investments

- Ensure marketing and sales input into business cases so that they reflect full costs to support an offering throughout its lifecycle

- Leverage a best-in-class process to interlock product, marketing, and sales throughout the innovation and go-to-market process

- Review portfolio regularly to avoid overcrowding and confusion

- Play a lead role in lifecycle investment decision-making, and carefully plan the execution of changes (e.g. end of life)

For further details on this Sirius Decisions Innovation Strategy Framework research brief check-out http://go.siriusdecisions.com/innovation_strategy

Helene Eichler is accomplished Channel Marketing and CRM professional running HRE Technical Marketing. She develops, executes and manages global marketing projects /programs in the IT, Network Security, Managed Services industries. As SVPMA’s Director of Communications, she is responsible for developing and implementing Communications and Marketing Strategies. Helene can be reached at hreichler@earthlink.net or through LinkedIn http://www.linkedin.com/pub/helene-eichler-capm-pmi-certification/0/43/568

#Finance #Roadmap #Development #Strategy #Planning #Market_Analysis #Marketing #Sales #Programs #Initiatives #Tools